Embodied Carbon: Conserving our way to sustainability

The demand for more sustainable real estate has continued to accelerate, sending a bright signal to real estate players to initiate change for reasons beyond arguments from environmental necessity. The burgeoning threat of holding stranded assets, suffering from unanticipated or premature write-downs, devaluation or conversion to liabilities, has prompted attitudinal change and action. Regulatory pressure has added to this mix, with the government proposing that all commercial properties being let have a minimum EPC rating of at least ‘B’ by 2030, as well as considering a possible interim requirement of level ‘C’ by 2027[1]. As a result, reducing the carbon emissions associated with operation and maintenance has been a major focus, often achieved via light retrofit, defined as performance optimisation, basic remodelling, replacement, or adaptation of existing building elements which tend to focus on a single aspect or feature, such as; lighting upgrades, optimisation of building controls and operation[2]. However, when it comes to prioritising deep retrofit of existing assets over demolition and new build, the story becomes quite different.

Evidence suggests that investors and developers are less inclined to consider how long the carbon associated with new construction takes to recoup - even in instances where there are substantial operational efficiency benefits[3]. The reasons for this are twofold; firstly, in the UK there is no requirement for developers and contractors to report on embodied carbon and no limit set on emissions, and secondly, embodied carbon considerations are not at the forefront of occupiers’ requirements.

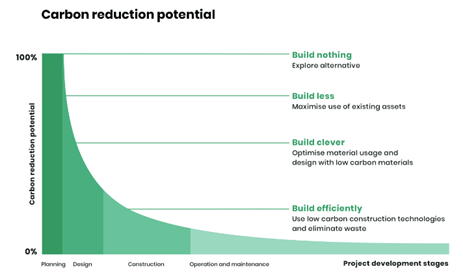

Diagram showing how opportunities to reduce embodied carbon decrease as the project progresses (One Click LCA)

The diagram above from One Click LCA helps demonstrate why this is concerning; it shows that the highest carbon reductions, at the lowest cost, are achieved early in the design process, or by exploring alternative options such as deep retrofit. Thereafter, carbon reduction potential decreases dramatically as many decisions affecting the project’s emissions are locked in, in the form of embodied carbon (the carbon emissions of a building created by its materials: their extraction, transportation, construction, maintenance, replacement, and end of life treatment)[4][5][6]. The science shows that it is crucial that investors and developers critically assess whether demolition followed by new construction of a ‘green’ asset truly helping combat the climate emergency.

With the average lifetime of an asset spanning between 30-130 years and existing buildings constituting around 90% of the stock until 2050, low retrofitting rates (<1%) at insufficient depth threaten decarbonisation targets[7]. To meet global emissions standards by 2050, the rate at which we are repurposing our commercial building stock needs to increase to around 5% annually[8]. When it comes to new developments (constructed when maximising the use of existing assets is not an option), pro-active asset owners are beginning to set their own embodied carbon targets at an organisational level, conducting Life Cycle Assessments where appropriate to improve and inform future developments. These assessments should be seen not as a one-off cost associated with a single asset but instead as an investment that allows one to accumulate knowledge that can be transferred across portfolios and shared with occupiers. At DTZ Investors, we learnt that by switching to different refrigerant type with lower warming potential, we could significantly reduce the carbon emissions associated with our co-living developments. It is vitally important that investors and developers take the initiative to proactively manage this risk, especially with the anticipated change in the regulatory landscape following the Carbon Emissions (Buildings) Bill being forward in parliament in February 2022.

With regards to deep retrofit, a mindset shift is needed, reframing the deterring long payback periods as a trade-off for holding attractive and sustainable stock in the future.[9] There is already speculation that we will see a preference for existing stock that has been retrofitted, as the market comes to place greater financial value on embodied carbon preservation, just as it already has for operational efficiency. Educating occupiers on the positive environmental and economic outcomes is hugely important and will help ensure collaboration between parties, achieved by quantifying future operational energy savings and providing guidance to regarding how carbon costs can be reduced. Rebalancing the focus away from demolition and new build, towards retrofitting and low carbon construction is vital from an economic and ecological perspective. Our thinking must become guided by the view the view that, “the greenest building is…one that is already built...we cannot build our way to sustainability; we must conserve our way to it'.[10]

[1] ———. 2022. “UKGBC Publish Guide to Accelerate Industry Action on Commercial Retrofit.” UKGBC - UK Green Building Council. May 4, 2022. https://www.ukgbc.org/news/ukgbc-publishes-guide-to-accelerate-industry-action-on-commercial-retrofit/.

[2] ———. 2022a. “Delivering Net Zero: Key Considerations for Commercial Retrofit.” https://ukgbc.s3.eu-west-2.amazonaws.com/wp-content/uploads/2022/05/05110851/Commercial-Retrofit-Report.pdf.

[3] M&G. 2022. “Embodied Carbon: Why a Building’s Lifespan Matters.” Www.mandg.com. 2022. https://www.mandg.com/investments/institutional/en-gb/insights/2022/q1/embodied-carbon--why-a-building-s-lifespan-matters.

[4] UKGBC. 2017. “Developing a Client Brief.” https://ukgbc.s3.eu-west-2.amazonaws.com/wp-content/uploads/2017/09/05153001/UK-GBC-EC-Developing-Client-Brief.pdf.

[[5]One Click LCA. (2021). Life Cycle Assessment for Buildings - Why it matters and how to use it. Oneclicklca.drift.click. oneclicklca.drift.click/building-lca-ebook

[6] WBCSD. (2021). Decarbonizing construction: Guidance for investors and developers to reduce embodied carbon. World Business Council for Sustainable Development (WBCSD). https://www.wbcsd.org/Programs/Cities-and-Mobility/Sustainable-Cities/Transforming-the-Built-Environment/Decarbonization/Resources/Decarbonizing-construction-Guidance-for-investors-and-developers-to-reduce-embodied-carbon

[7] Ivalin Petkov et al 2021 Environ. Res.: Infrastruct. Sustain. 1 https://iopscience.iop.org/article/10.1088/2634-4505/ac3321

[8] JLL (2021), Sustainability and value in the regions report: https://www.jll.co.uk/en/trends-and-insights/ research/sustainability-and-value-in-the-regions

[9] Voland, N., Saad, M.M. and Eicker, U. (2022). Public Policy and Incentives for Socially Responsible New Business Models in Market-Driven Real Estate to Build Green Projects. Sustainability, 14(12), p.7071. doi:10.3390/su14127071.

[10] Elefante, Carl. (2012). The Greenest Building Is... One That Is Already Built. Forum Journal. 27. 62-72.

Image: OLYMPUS IMAGING CORP., E-M1 - Free to use under the Unsplash License