|

|

We think long-term at DTZ Investors. Over the past decade we have increased our focus on environmental and economic sustainability. Embedding environmental and social considerations into our investment process and our asset management philosophy. Our Responsible Investment (RI) programme combines environmental and wider social benefits with financial returns that are assessed over the very long-term. The targets we set ourselves as we move forward will look to achieve an impact beyond our four walls. |

|

Our RI strategy focuses on protecting income and generating long-term income growth from our investments. We work in close partnership with our occupiers to ensure that our properties suit their requirements today and adapt as their businesses evolve. The importance we place on maximising income over the long-term influences our corporate governance structure, informs our investment philosophy, shapes our asset management style and determines our reward structure. Successful implementation of our RI strategy has been a fundamental contributor to our exceptional investment performance track record. We have enjoyed consistent outperformance for clients in the UK, averaging 180 basis points of annual outperformance as a house against the MSCI Benchmark over the last 20 years. RI is embedded in our philosophy and culture. We generate long term, sustainable value for our clients through our investment decision making and believe that we have a responsibility to manage those assets in a manner that is sensitive to the environment, provides a social benefit and is set within an overarching framework of strong corporate governance. By investing responsibly and managing our assets in a way that generates societal and environmental benefits, we make our buildings more attractive to consumers, employees, business owners and investors, which generates better long term performance and better results for all stakeholders. |

|

We have built our responsible investment approach on 4 core pillars

|

1. Leadership and Governance Integrate RI principles throughout our culture, business activities and processes and assign lines of responsibility. Collaborate with government, our peers and our clients to encourage adoption of RI practices across the industry. |

2. Investment Process and Implementation Manage, maintain, upgrade and dispose of our clients’ assets |

You can access our RI Report here. |

|

3. Benchmarking and Disclosure Share our ESG performance against industry benchmarks publicly, and identify opportunities for continual improvement.

|

4. Stakeholder Engagement Educate and engage with clients, occupiers, our people and local communities to enable effective decision‐making and action that leads to positive environmental and societal impact across our corporate & real‐estate activities. |

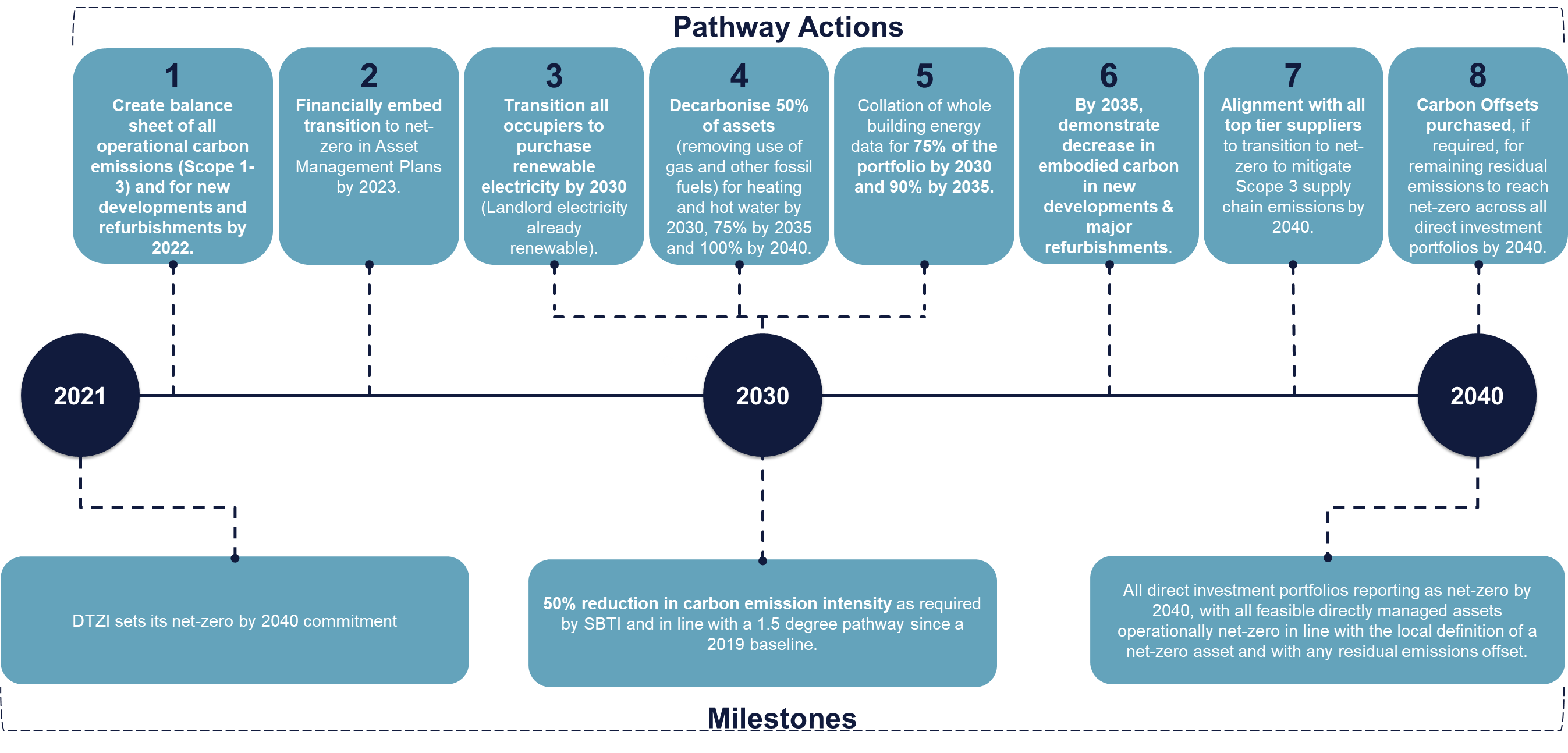

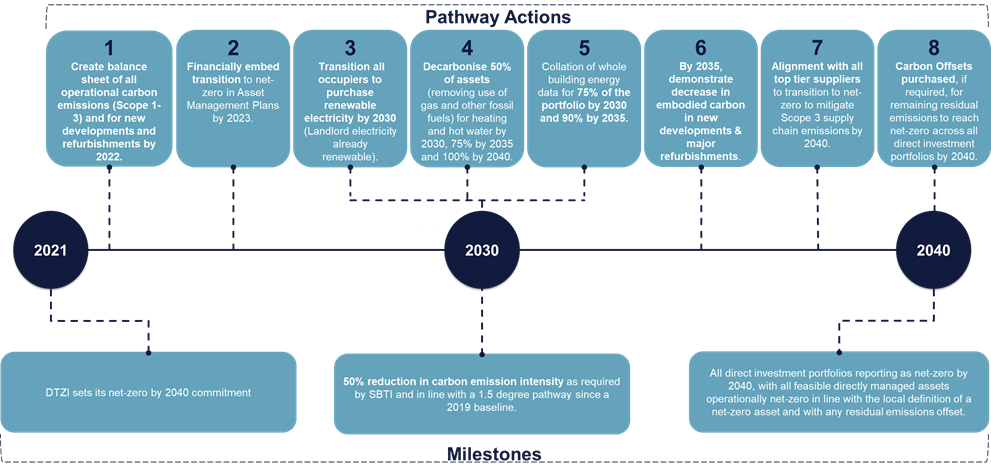

We have committed to transition to Net Zero by 2040

|

We are committed to achieving net-zero carbon for our clients' direct holdings by 2040. This is an ambitious time frame as our portfolios are diverse, with broad range of asset type, geography, age, use and occupier. You can access out net-zero pathway here.

|

|

|

|

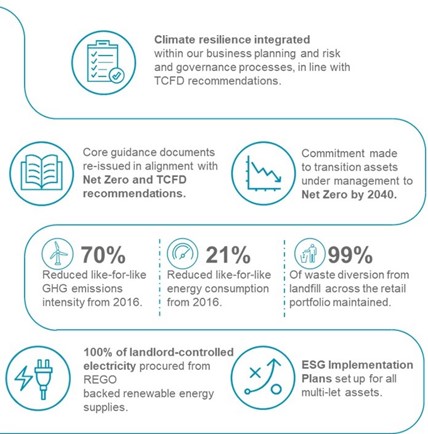

We share our performance publicly to ensure transparencyReporting and benchmarking is an essential part of DTZ Investors’ RI strategy where disclosure of ESG performance to internal and external stakeholders ensures transparency and sharing of best practice. In addition, disclosure allows comparison and benchmarking of performance internally and externally to be undertaken which supports measurement of progress and performance over time.

|

We target high standards of governance, organisation and risk managementWe support several international organisations to help determine best practice and openness in reporting, and have committed to being transparent on our performance to ensure improvement over time. We have arranged our business, our teams and our supply chain to ensure Environmental, Social and Governance (ESG) factors are integrated into strategy, decision making and implementation. The Board has accountability and ultimate responsibility for embedding and driving RI, and this year, to demonstrate our commitment to embedding RI into our business and investment processes, we appointed Jennifer Linacre, as our Head of Responsible Investment. Jennifer chairs our Responsible Investment Committee (RIC), which sets policy for the group on all matters relating to Environmental, Social and Governance standards in connection with the assets we manage for clients and our own approach as a business and occupier of real estate. The RIC meets monthly to ensure progress is maintained and strategy remains relevant and impact driven. Our RI policy is set annually and is reviewed quarterly. The policy is rolled out across the business by the RIC. Fund and Portfolio managers report quarterly to ensure progress is maintained and individuals are held accountable for actions undertaken during the quarter. See our Responsible Investment Policy here.

See our Human Rights Policy Here |

|

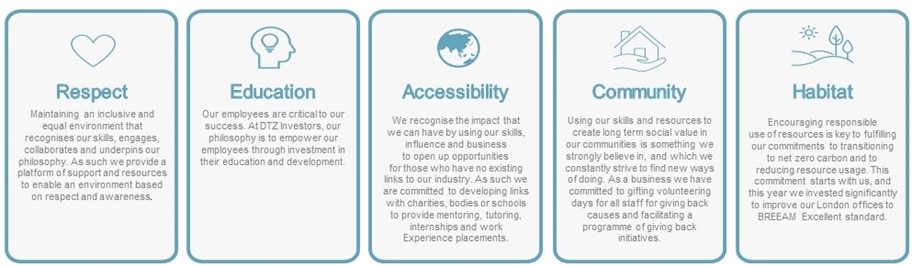

We strongly believe in using our resources, expertise and influence to create social valueIn 2020, we launched our REACH programme; a commitment to invest our time, money and expertise in causes that affect our society in the areas of Respect, Education, Accessibility, Community and Habitat.

|

|

|