26 November, 2021

COVID-19 drives record demand in the under-supplied Self Storage Sector. Martin Gilbert considers the diversification benefits.

In a previous article, it was argued that real estate equities could provide direct real estate investors with some much-needed liquidity. As a follow-up, the indirect investment team at DTZ Investors has turned its attention to consider the potential diversification benefits of investing in listed companies operating in “alternative” real estate segments, such as primary healthcare, self-storage, residential and social housing. Here Martin Gilbert considers the self-storage sector which has fared well through the pandemic and which has fundamentally different drivers from the more mainstream sectors of office, retail and industrial. Moreover, the UK REIT market offers ready access into this “alternative” real estate segment when exposure is difficult to achieve either directly or via non-listed UK funds.

‘A self-storage unit is a securable static space less than 500 sq ft in size that is to be used by a person or business for the storage of their goods. The customer will have exclusive and ready access to the space. This unit would be rented under a self-storage contract that was not part of, or tied to, an additional agreement such as a residential tenancy, office space, workspace or similar.’ Self-storage Association UK

The Background

Only becoming established in the early to mid-1990s, self-storage is still a relatively immature market in the UK. According to statistics from Self Storage Association UK (SSA UK), the sector attracts both traditional personal users and private businesses, accounting for 70% and 30% of the user base respectively, but only 50% of the population in the UK have a good awareness of the self-storage business. There is a large number of firms providing stores, but the major operators in the UK are all listed companies: Big Yellow, Safestore, Shurgard and Lok’nStore.

Encouragingly, new self-storage facilities have increasingly embraced sustainable practices, including solar panels and green roofs.

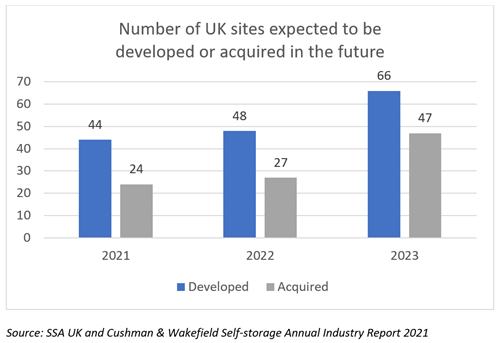

The UK has approx. 2,000 stores (of which c.600 are container based) with an average size of c.25,000 sq. ft, average annual net rental rate of c.£24 per sq. ft and occupancy of c.82% (Source: SSA UK / C&W). As in the US, the specialist self-storage REITs are the main driver of new development activity.

Optimal occupancy for a mature self-storage facility located in a major metropolitan area is usually considered to be between 85%-90%. It usually takes 3 to 5 years for a new self-storage facility to reach maturity. In 2020, almost 100 stores of various sizes opened in the UK despite delays in developments. Encouragingly, new self-storage facilities have increasingly embraced sustainable practices, including solar panels and green roofs. The three biggest costs for operators are staff (32%), rates and taxes (24%), and management (17%). Individual self-storage stores do not employ many people with even the largest stores only having three full time staff on average.

The COVID effect

During 2020, the self-storage industry had a particularly good year with significantly increased occupancy and strong investor returns. Self-storage was deemed to be a part of the logistics chain, classed as an essential service and thus allowed to remain open under certain conditions during lockdowns. Some businesses have even been assisting the NHS in storing pandemic-related supplies.

Personal user occupancy of self-storage is driven by life events and the COVID-19 pandemic brought these and other drivers in the sector into sharp focus:

- Significant spike in death rates: a death in the family is the most common life event that necessitates the use of a self-storage facility;

- Widespread requirement to work from home: a change in working environment is another typical driver and many have needed storage to create space for a ‘home office’;

- Increased activity in the housing market: the stamp duty holiday introduced shortly after the onset of the pandemic saw a sharp uptick in house moves which often require use of storage;

- Growth in small/medium-sized online retailers: the boom in online retail has required increased stock holdings, and therefore storage;

- Higher divorce rate: divorcees are twice as likely to use storage facilities and an unfortunate effect of the pandemic has seen divorces at a 50 year high in the UK .

As a result of lockdowns, customers stayed longer, and the churn rate was reduced. Interestingly, when looking at the occupancy rate throughout 2020, there was an increase in occupancy when lockdowns were eased over the summer, rather than a reduction, indicating there was no mass move out and that the use self-storage facilities is likely to stick. Allied to this, it is looking increasingly likely that some form of flexible working is here to stay for office workers, making the need for working space at home a permanent one. With online retailing having now tapped into new age groups during the pandemic as well, the need to store higher levels of online stock is also unlikely to diminish.

Longer term attractions

Moving away from the near-term impacts from the pandemic, the sector can also point to several inherent long-term attributes:

- Diversification. Data shows that self-storage returns are weakly correlated with those of other property types, and looking back, the sector also delivered more robust returns during the Global Financial Crisis.

- Inelastic demand & considered as essential business. As highlighted above, demand for storage comes from both positive and negative life events, such as moving, employment, birth, death, marriage and divorce, all of which occur regardless of the state of the economy. Indeed, historically, self-storage has been known to be countercyclical, performing well in a downturn.

- Long-term demographic factors. Societal changes, such as the increase in mobility of the workforce, urbanisation, immigration, and the increase in individuals and households remaining in multi-family housing for longer are all factors fuelling growth in the sector.

- Robust demand from businesses. Businesses account for close to 30% of all self-storage tenants in Europe, according to the SSA. Self-storage offers a cost-effective option and space flexibility for businesses, especially for the rising e-commerce retail trade. Operators are now catering more for business customers offering free Wi-fi, meeting rooms, mailboxes and courier services.

- Technological improvements & management efficiencies. In-place technology, such as contactless rentals, auto pay and gate access integration improve efficiency and the introduction of improvements such as these was hastened by the pandemic.

- Cost efficiency. Land and build costs are typically modest given stores are generally sited in more secondary locations and specification is standardised. Once completed, a store has large income potential with low overheads and relatively low ongoing management expenses. The break-even occupancy rate for a self-storage facility is approximately 40%-45%.

- Dependable and predictable income & positive income growth. Customer rent payments are collateralised by the goods in the storage units and leases are month to month, allowing operators to capture rental growth faster.

A more in-depth look

DTZ investors is a wholly owned subsidiary of the Cushman & Wakefield (C&W) group. For more detailed information on the sector, the C&W UK self-storage team has recently released their Self-storage Annual industry Report 2021 in association with SSA UK. An online dashboard is also available which examines how the industry has performed in the last five years, allowing you to interrogate the data based on geography and other demographics.

Martin Gilbert is head of the Indirect Investment team at DTZ Investors, where he is responsible for the management of all indirect client mandates in the UK and internationally.

Latest News

8 December, 2025

UK

Planning Permission Secured and Works Commence at Perimeter One & Perimeter Two, Crawley

26 November, 2025

UK

DTZ Investors secure Aldi at Anchor Retail Park

21 November, 2025

UK

DTZ Investors acquires £100m off-market grocery portfolio

13 November, 2025

UK

DTZ Investors Completes Purchase at Hatch Industrial Estate, Basingstoke