10 August, 2023

Property as an inflation-hedge

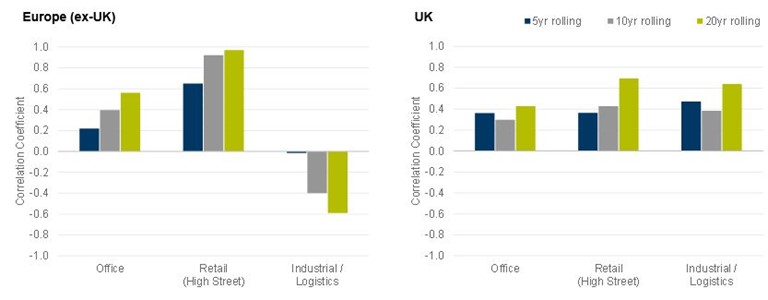

- INREV’s latest study, which was produced in conjunction with PMA, assesses the correlation between inflation and rental values on 5, 10 and 20 year rolling holding periods across Europe ex-UK real estate markets. The results of the analysis show a relationship between the two variables, although the strength and direction of the correlations vary by sector.

- Retail rental values had a strong, positive correlation with inflation on 5, 10 and 20 year rolling holding periods. Office rental values were also positively correlated, but to a lesser extent than for retail whereas the correlation between industrial rental values and inflation was virtually non-existent on a 5-year rolling basis and negative on rolling 10 and 20 year holding periods.

- We replicated the analysis with data on the UK’s real estate market to see if any discernible differences could be found. We observed some differences, which are set out in the charts below. Similar to the rest of Europe, the UK retail and office rental values were positively correlated with inflation, albeit the office correlations were more consistent across the rolling periods, while the strength of the retail correlations were slightly weaker than in Europe. The biggest disparity was in the industrial sector, where in contrast to the rest of Europe, the co-movements between rental values and inflation were positive over all time periods.

- This is likely due to maturity and scale of the UK’s e-commerce market, which is far larger and more advanced than any other e-commerce market in Western Europe according to the Centre for Retail Research. Thus, as retailers have expanded their multi-channel operations into the logistics space creating a structural shift in the demand for industrial stock, this has boosted rents and improved the sector’s ability to hedge inflation.

Average correlations over different time periods - rents versus inflation

Source: INREV/PMA, DTZ Investors

- However, the past is no guide to the future, and although the UK’s property sectors have provided a hedge against inflation historically, several factors could compromise property’s inflation-hedging characteristics going forward.

- The INREV report cites a few of these, including: the increased use of turnover leases in the retail sector, affordability pressures, less favourable shifts in monetary policy conditions and the impact of technological shifts on occupational markets.

- We consider a number of other factors should also make this list, including the use of indexation in the lease structure, demographic shifts, behavioural changes, deglobalisation and sustainability. All of these forces have the potential to either bolster or suppress rental growth prospects across the property segments.

- Moreover, when it comes to real estate’s inflation-hedging capabilities, the type of inflation (demand-pull or cost-push) and the rate of GDP growth matters. For example, in times of high GDP growth and high inflation (i.e., demand-pull inflation) such as 1983 to 1989, UK rental values surpassed inflation, whereas when inflation was driven by a supply-side shock and economic growth was anaemic as per 1979-1981, 1990-1992 and 2022, very few segments offered an inflation hedge.

- According to HM Treasury consensus forecasts, the low growth, high (supply-induced) inflationary conditions that we are currently experiencing will persist over the new few years, creating a difficult environment for rental values to prosper. This view is consistent with the outcomes of our latest market forecasts, which predicts rental values will decline in real terms across most of the UK’s property segments over the next 5 years with only a handful of segments expected to deliver above-inflation rental growth.

- As a result, real estate investors may look to narrow their asset allocation preferences, targeting those sectors that will benefit from larger structural forces or are underpinned by a structural mismatch in demand and supply (industrial and logistics, residential and student housing and the senior living sector). These segments, together with assets that contain some form of annual inflation indexation, should provide the best protection from inflation.

Latest News

8 December, 2025

UK

Planning Permission Secured and Works Commence at Perimeter One & Perimeter Two, Crawley

26 November, 2025

UK

DTZ Investors secure Aldi at Anchor Retail Park

21 November, 2025

UK

DTZ Investors acquires £100m off-market grocery portfolio

13 November, 2025

UK

DTZ Investors Completes Purchase at Hatch Industrial Estate, Basingstoke