8 December, 2023

Breaking through the noise: The viability of open-ended real estate funds in the wake of ongoing redemption deferrals

Open-ended real estate funds are once again the centre of attention with redemptions deferred or suspended, begging the question whether such vehicles are fit for purpose given their liquidity is challenged in times of stress. The answer is a resounding yes, argues Sam Berry of DTZ Investors.

In the second half of 2022, several of the larger open-ended real estate funds in the UK received significant volumes of redemption requests which could not be satisfied. Whilst “gating” is nothing new, the drivers behind the recent run on open-ended real estate funds are different.

A perfect storm leads to a redemption flood

In our view, the abnormal level of redemption requests seen in the second half of 2022 were driven by three factors:

- The Denominator In 2022, central banks in mature economies responded to rising inflation by raising interest rates, which triggered a wider market correction, most noticeably in the public markets. Equities and bonds, which make up the majority of traditional institutional portfolios, sold off. Private market investments, such as real estate, lagged the wider correction because valuations are appraisal based, rather than market based. As a result, institutional portfolios became overweight to real estate, prompting a sell off to rebalance portfolio exposures and bring them closer to target allocations.

- De-risking. In the UK, higher bond yields have reduced the discounted value of defined pension fund liabilities, thereby bringing forward fund maturities and prompting divestment from higher risk assets, including real estate, to make the asset portfolio more attractive for insurance buy- out purposes.

- Gilts The Truss Government’s mini-budget on 23 September 2022 triggered a sell-off in the gilt market as it implied unfunded spending. The 10-year gilt yield rose rapidly, increasing from 3.50% on the day before the mini-budget to 4.51% five days later. This abrupt change created challenges for defined benefit pension funds that held Liability Driven Investments (LDIs) because it prompted collateral calls1. The immediate challenge was finding liquidity quickly enough to cover positions. On 28 September 2022, the Bank of England was forced to intervene because UK financial stability was at risk from a self-reinforcing downward price spiral affecting long-dated Government debt2. The Bank pledged to buy long-dated Government debt which eased the liquidity pressures on pension funds that held LDIs and led to a reduction in yields, giving some respite from collateral calls. Nevertheless, the search for liquidity had prompted pension funds to submit redemption requests to liquidate indirect real estate positions.

These drivers coincided with a period during which real estate asset values were already falling. Debt- backed real estate buyers were seeing borrowing costs increase markedly while higher risk-free rates were translating into higher required returns for equity buyers. Consequently, there was a wide disparity between the pricing aspirations of both buyers and sellers in Q4 2022 and transaction volumes dropped to levels not seen since 2008/9. This created a liquidity mismatch between the open-ended funds under redemption pressure and the direct real estate market. Fund managers were unable to conduct orderly asset sales to meet redemptions requests.

As a result, we saw and continue to see some of the largest real estate managers defer redemptions to complete orderly sales programmes to ensure both remaining and exiting investors are treated fairly.

A question of viability

Given the renewed liquidity issues with open-ended real estate funds, are such funds suitable for long- term investors seeking indirect exposure to real estate?

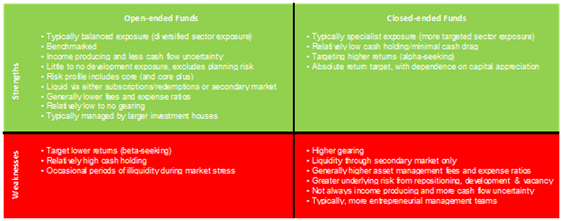

To answer this question, it is important to revisit the strengths and weaknesses of open-ended real estate funds and compare these to the alternative, closed-ended vehicles.

As the table above shows, open-ended real estate funds do offer appealing characteristics in the indirect investment space. The needs of institutional investors differ materially, but those seeking:

- lower risk property portfolios in terms of quality and location;

- property with consistent and more predictable income streams;

- property that can be held long term to minimise transaction costs; and

- established management teams charging reasonable fees,

can benefit from open-ended real estate funds. This is due to the following attractive characteristics found amongst such funds:

- Size: Open-ended real estate funds typically provide investors with a way to pool capital with others and gain access to a diversified portfolio of underlying assets and income streams. Units or shares can be issued or redeemed on a periodic basis, typically quarterly, but in some cases, annually. As at the end of 2022, the MSCI All Property Fund Index (MSCI PFI) had 32 open-ended funds accounting for 88% of Gross Asset Value (GAV). These funds vary in size ranging from small (c.£82m, 12 assets) to large (c. £3.3bn, 74 assets). In general, these funds provide diversified sector exposure which mitigates sector-specific risk.

- Debt: Overall, open-ended real estate funds have lower gearing with the weighted average of all open-ended funds in the MSCI PFI being just 7% (Q4 2022). However, this figure is skewed somewhat because 25 of 36 funds have no gearing. With higher interest rates, debt might not be accretive to performance which is why we could see further deleveraging.

- Income: As at the end of 2022, amongst the open ended funds in the MSCI PFI that distribute, the weighted average yield was 5%, but the range was wide from the lowest of 2.3% to highest of 5.7%. The yields from open-ended property funds have been consistent over time, with the five year average of distributing funds being 3.5% p.a.

- Capital: Up to the end of 2022, annualised capital value growth from direct property assets over 5 and 10 years was –2.0% and 1.8% respectively. In contrast, the 28 open-ended real estate funds that have a 5 and 10 year performance record with the MSCI PFI on average delivered 0% and 3.6% over those time periods respectively. However, there is considerable variation so diligent fund selection is key as the worst funds delivered -2.9% over 5 years and 0.1% over 10 years. In contrast, the cohort also includes a specialist single sector open-ended fund that delivered capital growth of 8.1% over 5 years and 10.5% over 10 years.

- Fund Life and Liquidity: open-ended funds are evergreen, and, in theory at least, more liquid because units/shares can be periodically created or cancelled in accordance with fund documentation. Even when dealing in these funds is suspended, an investment or divestment is possible through the secondary market. In “normal” market conditions, secondary pricing typically rotates around NAV with the premium and discount boundaries being set by the issue and redemption prices respectively. For example, in mid-2021 secondary market bid prices ranged from -5.0% to NAV to +3.5% to NAV and offer prices from -2% to +6% to NAV. However, in more stressed market conditions, secondary market spreads widen considerably reflecting the direction of fund flows. In November 2022, two of the most liquid and sought after diversified open-ended funds saw bid prices at -25% and offer prices at -15% to NAV.

- Fees & Costs: open-ended real estate funds typically have lower fees and expense ratios, which is beneficial for longer term investors, as this allows for returns to be more effectively compounded. An INREV analysis of fees and costs published in 2022 based upon a sample of 61 funds, which showed that the weighted average total global expense ratio (TGER) was 1.35% on NAV, but larger open-ended vehicles operating a core strategy had lower TGERs.

These appealing characteristics of open-ended real estate funds have been strengthened by industry and regulatory efforts to better manage liquidity.

A history of regulatory reviews

This is not the first time that open-ended real estate funds have been unable to satisfy large volumes of redemption requests. Similar occurrences took place during the Global Financial Crisis, after the Brexit referendum in 2016 and more recently, at the outset of the COVID-19 pandemic in 2020.

These periods of stress prompted industry-wide initiatives and regulatory interventions:

The Open End Fund Pricing Project was an industry-wide initiative conducted by the Association of Real Estate Funds in conjunction with INREV (European Association for Investors in Non-Listed Real Estate). The first phase completed in July 2018 and there was then a consultation phase in 2020. In addition to general guidelines on pricing mechanisms, specific recommendations were made on pricing in dislocated markets. Specifically, managers were required to evaluate pricing and consider adjustments to ensure that there is no material transfer of value between remaining and exiting investors. It was also proposed that the terms of redemption penalties should be outlined in constitutional documents and such penalties should not be used as a discretionary component of fund pricing adjustments in dislocated market situations.

In July 2019, the FCA and the Bank of England’s Financial Policy Committee commenced a joint review into the vulnerabilities associated with open-ended funds offering redemption terms which did not match the liquidity of the underlying assets. It was widely recognised that this mismatch created an incentive for investors to redeem ahead of others, particularly during periods of stress. A survey was undertaken in 2020 covering open-ended authorised funds investing in less liquid assets, primarily corporate bonds, but also mixed bond funds and small/medium cap equity funds. Funds investing in illiquid assets, including real estate, were not included. However, the joint report by the Bank of England and FCA, published in March 2021, identified a wide range of liquidity management tools that could be called upon by fund managers of open-ended funds during periods of net flows, some of which are evident in open-ended real estate funds:

- Swing pricing: unit price adjustment to reflect the dealing costs of buying and selling investments for the fund. In practice, it is challenging for real estate funds to implement swing pricing effectively because pricing adjustments require reasonable information on the price, liquidity, and transaction costs of an asset.

- Dual pricing: units are priced differently for subscriptions and redemptions. This is the approach used by almost all open-ended real estate funds because it mimics the charges that funds face when buying or selling real estate Even the larger authorised retail open-ended funds now price subscription and redemptions on a dual price basis.

- Dilution levy: a charge is imposed on specific redeeming or subscribing investors to offset the price impact of their redemption or subscription.

- Deferred redemptions: typically activated when net outflows exceed a certain specified threshold with redemptions being deferred to the next dealing day. The managers of several open-ended real estate funds deferred redemptions to protect remaining investors from the detrimental impacts of forced sales into a falling Managers generally have up to two years to pay out redemptions. In Q1 2023, direct real estate market transaction volumes picked up, allowing for some orderly asset sales to be made to facilitate partial payments.

- Redemptions in kind: distribution of the underlying assets to investors, instead of paying cash to honour redemptions. In practice, this option is restricted to large institutional investors, and it would be challenging to apply in a real estate context.

- Temporary changes: in the dealing frequency of the

- Temporary borrowing to cover redemptions: the managers of open-ended real estate funds have shown a distinct reluctance to take on debt to fund redemptions, particularly where debt is not accretive to performance.

In July 2021, the Bank of England’s Financial Policy Committee set out three key principles for fund design aimed at delivering greater consistency between funds’ redemption terms and their underlying assets:

- Liquidity classification: The liquidity of funds’ assets should be assessed either as the price discount needed for a quick sale of a representative sample of those assets or the time needed for a sale to avoid a material price discount.

- Pricing adjustments: Redeeming investors receive a price for the units in the fund that reflects the discount needed to sell the required portion of a fund’s assets in the specified redemption

- Notice periods/redemption frequency: Redemption notice periods should reflect the time needed to sell the required portion of a fund’s assets without discounts beyond those captured in the price received by redeeming The FCA’s earlier consultation (August 2020) proposed notice periods of between 90-180 days.

Building on the above, the FCA issued proposals in October 2021 for a new authorised open-ended fund aimed primarily at defined benefit pension scheme investors seeking access to long-term illiquid

assets, including real estate, but with redemption terms that better match the underlying investments. As at the time of writing, we are aware of only three Long Term Asset Funds which have launched.

Open-ended funds continue to have a role

In summary, open-ended real estate funds continue to meet the objectives of long-term real estate investors despite intervals of illiquidity during periods of market stress. More specifically, open-ended real estate funds meet the preferences for low-risk investments that generate consistent and predictable income streams with minimal long term capital losses. These funds can be held long term at lower-than-average expense ratios, and in normal market conditions provide the liquidity required, either through subscription/redemption or via secondary market transactions to reposition portfolios as and when the need arises.

Latest News

8 December, 2025

UK

Planning Permission Secured and Works Commence at Perimeter One & Perimeter Two, Crawley

26 November, 2025

UK

DTZ Investors secure Aldi at Anchor Retail Park

21 November, 2025

UK

DTZ Investors acquires £100m off-market grocery portfolio

13 November, 2025

UK

DTZ Investors Completes Purchase at Hatch Industrial Estate, Basingstoke